Table of Contents

Khata vs Invoicing Software: Running a shop today is no longer just about selling goods—it’s about managing your business effectively. While traditional khata systems still exist, digital khata and invoicing software have become essential tools for modern shopkeepers.

Let us explore the differences, benefits, and ideal use cases for both, helping you make the right choice for your business.

Understanding Khata and Invoicing Software

Khata vs Invoicing Software is a growing discussion among shopkeepers today. Khata is the traditional way of recording customer credit. Now, with smartphones, businesses use digital khata and invoicing software to manage records more efficiently. Digital khata tracks udhaar and sends automated reminders, helping improve cash flow.

On the other hand, invoicing software allows you to generate GST-compliant bills, track payments, and manage inventory. Today, many retailers combine both digital khata and invoicing software to stay competitive in the market.

What is Digital Khata?

A digital khata is a tool that helps you record and manage customer transactions. It replaces the old notebook with a digital ledger, which often comes with payment reminders.

Benefits of Digital Khata:

- Easy to operate

- Tracks balances

- Sends payment reminders

Using digital khata and invoicing software together ensures efficient management of both credit and sales.

What is Invoicing Software?

Invoicing software is a digital solution that creates professional invoices, supports GST billing, and tracks stock and payments. Businesses that need digital or printed bills prefer using khata and invoicing software in combination.

Benefits of Invoicing Software:

- GST-compliant billing

- Inventory management

- Payment and report tracking

With digital khata and invoicing software, even small vendors can deliver professional customer experience.

Digital Khata vs Invoicing Software: The Key Differences

| Feature | Digital Khata | Invoicing Software |

| Main Use | Tracking credit and dues | Creating professional invoices |

| Suitable For | Small shops with credit customers | Shops needing printed or GST bills |

| Invoice Creation | Not available | Available with formats and GST |

| Payment Tracking | Basic | Detailed with online payments |

| Reports and Stock | Very limited | Available in most billing apps |

| Layout | Informal (like a notebook) | Professional (used for billing) |

When Should You Use Digital Khata?

Digital khata is best for local businesses that have frequent credit sales. It simplifies udhaar management and improves customer follow-ups. Using digital khata and invoicing software side by side offers powerful business control.

When Should You Use Invoicing Software?

If your business requires bills, tracks stock, or deals with tax filing, invoicing software is a must. It is the preferred billing software for small business operations. You can even find tools that merge khata and invoicing software into one app.

Real-World Industry Use Cases

- Retail Sector: Billing software for retail shop owners ensures easy checkout, billing, and stock tracking. It’s ideal for shops looking to adopt invoice billing software.

- Food Industry: Restaurant billing software helps manage orders, tables, and bills. It enables smooth operations at busy food and takeaway counters.

- Automotive Sector: Automotive invoice software lets garages create bills that detail parts and labour separately. It simplifies invoicing in the garage.

- Freelancers and Contractors: The best invoicing software for contractors and invoicing software for freelancers helps track project hours and automate the overall billing process.

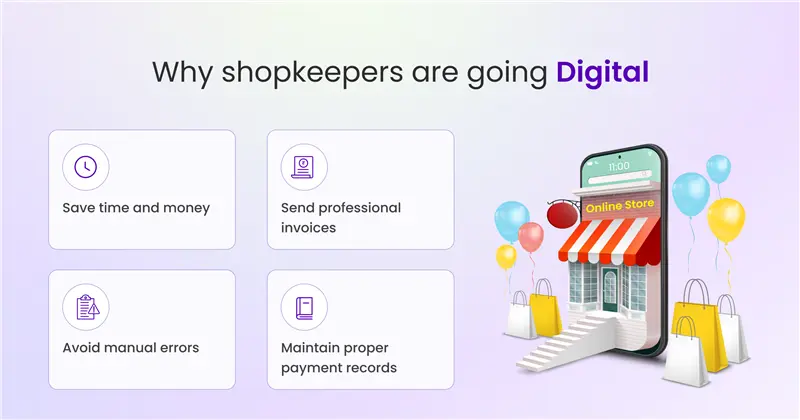

Why Shopkeepers Are Going Digital

From local kiranas to growing startups, businesses are switching to digital khata and invoicing software. It helps them to:

- Save time and money

- Avoid manual errors

- Send professional invoices

- Maintain proper payment records

Khata vs Invoicing Software is no longer an either-or decision—modern billing and invoicing software combines all the essential features in one place. Whether you need invoice and payment tools for your shop or simply want to maintain credit records, digital khata and invoicing software help you manage everything more efficiently.

Choosing the Right Tool – Here’s how to decide:

- If your business involves a lot of credit transactions: Use digital khata.

- If you need professional billing and stock tracking: Choose invoicing software.

- For complete control: Use digital khata and invoicing software together.

Many tools act as all-in-one billing software for small business use, making them efficient and reliable.

Khata vs Invoicing Software: Using Both for Better Results

A smart approach is using both khata and invoicing software:

- Digital khata handles credit transactions.

- Invoice billing software manages in-store sales and inventory.

This combined strategy is especially useful for retail, service, and food businesses.

Affordable Digital Solutions

Khata vs Invoicing Software is a key comparison for modern business owners looking to streamline operations. You don’t need to spend a lot—many billing and invoicing software providers offer low-cost or basic plans. Even the best invoicing software for contractors and automotive businesses is now easily accessible.

To run a successful business today, you need more than just a ledger. Digital khata and invoicing software simplify billing, improve accuracy, and speed up payment collection. Make the smart switch to digital khata and invoicing software, and manage your business more efficiently.

Shopaver brings together the best features of both Khata and invoicing apps to provide POS solution for your business. With Shopaver, you get accurate billing, efficient inventory management, and easy record-keeping.

FAQs

2. What is invoicing software?

Invoicing software is used to make bills, track payments, and manage stock. It creates GST-compliant invoices and helps with proper record-keeping.

3. Can I use both together?

Yes, using both helps you track credit and manage billing in one place.

Aachal has 5+ years of experience in retail technology and POS-related content, writing practical and insight-driven blogs for small businesses in India.