When you run a business, waiting for customers to pay their bills can be stressful. Late payments impact your cash flow and slow down growth. But you don’t have to spend hours every week sending reminders. With automate payment reminders and receivables automation, you can save time and get paid faster.

Here is how accounts receivable automation works, why it’s useful, and what to look for in the best accounts receivable software for your business.

Why Late Payments Are a Problem – And How to Fix Them

Many small businesses struggle because customers delay payments. This can lead to:

- Less money to pay suppliers and employees

- Extra work tracking unpaid invoices

- Wasted time chasing customers

The good news is, using automate payment reminders and accounts receivable automation makes collecting payments much easier.

What Is Accounts Receivable Automation?

Accounts receivable automation means using software to handle all your billing and collection tasks. Instead of making phone calls or writing emails yourself, the system does it for you.

This type of software helps you:

- Send invoices automatically

- Schedule automate payment reminders

- Track who has paid and who hasn’t

- Create reports about overdue payments

With the best accounts receivable automation software, you can focus on running your business instead of worrying about unpaid bills.

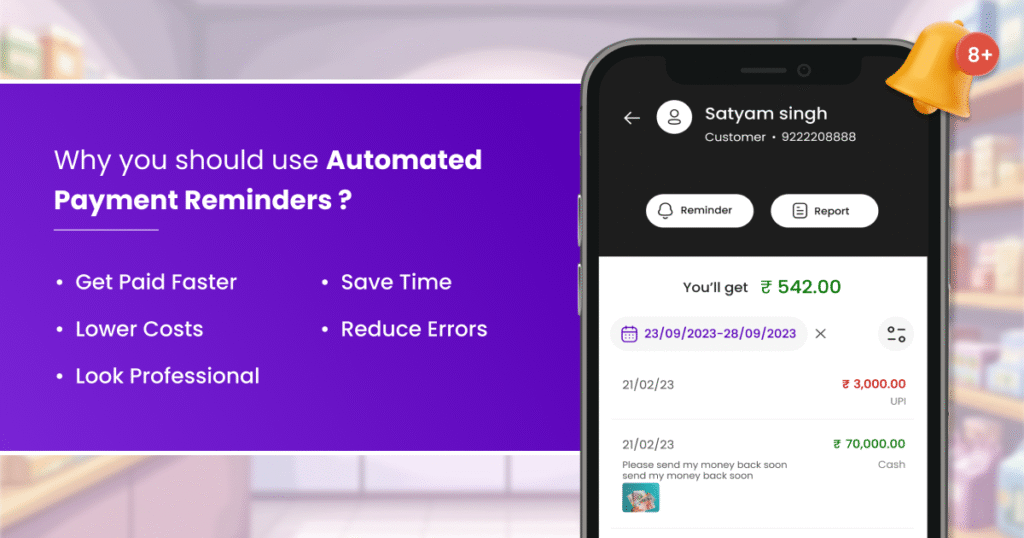

Benefits of Automate Payment Reminders

Here are some reasons why more businesses are using receivables automation:

1. Get Paid Faster

When customers get regular reminders, they are less likely to forget about invoices. Automatic messages make it clear that you expect timely payment.

2. Save Time

No more manual follow-up calls or emails. The software sends automated invoice reminders on the dates you choose.

3. Reduce Errors

Automation keeps records updated, so you don’t mix up payments or forget to follow up.

4. Look Professional

A good system makes your reminders look polite and branded, so customers trust you more.

5. Lower Costs

By automating reminders, you save time, which can be utilised for another business purpose.

What Automated Invoice Reminders Work

Most accounts receivable automation software is simple to set up. Here’s how it usually works:

- Upload Your Customer List: Import names, emails/numbers, and due dates into the software.

- Create Invoice Templates: Add your logo, payment details, and terms.

- Set Reminder Rules: Choose when to send automate payment reminders—like 3 days before due date, on the due date, and 5 days after.

- Send and Track: The system sends reminders automatically and shows who opened them.

- Follow Up if Needed: For very late payments, you can send final notices or call the customer.

With receivables automation, you don’t need to remember any of these steps yourself.

Choosing the Best Accounts Receivable Software

There are many tools available, so it’s important to pick the best accounts receivable software for your needs. Here are things to look for:

Ease of Use:

The software should be simple, even if you are not tech-savvy.

Custom Reminders:

Make sure you set your own schedule for automated invoice reminders.

Integration:

Good software connects with your accounting or billing system.

Reports:

Choose a tool that shows which invoices are paid and which are overdue.

Security:

Your customer data must be safe and private.

Extra Tips to Reduce Outstanding Credit

Even with receivables automation, you should follow some best practices:

- Be Clear: Always mention payment terms and due dates on every invoice.

- Send Invoices Promptly: Don’t wait days to send bills after work is done.

- Offer Easy Payment Methods: UPI, cards, and online payments help customers pay faster.

- Thank Customers: When a customer pays on time, send a thank-you message.

- Follow Up Personally: If automated reminders don’t work, make a polite phone call.

These small actions, combined with accounts receivable automation, will help you collect payments without stress.

Late payments are a common problem for businesses. But with automate payment reminders, you don’t have to waste time and energy chasing invoices.

If you haven’t started yet, try the best accounts receivable software today.

FAQs

1. How do automate payment reminders work?

They send emails or messages to customers before and after the invoice due date.

2. Is receivables automation expensive?

Many tools are affordable, and some have free plans for small businesses.

3. Can I customize reminder messages?

Yes, most software lets you add your own text and branding.

Aachal has 5+ years of experience in retail technology and POS-related content, writing practical and insight-driven blogs for small businesses in India.