Table of Contents

Are you running an E-commerce business that is fully GST compliant?

Navigating tax compliance can be tricky and may lead to heavy penalties when it comes to tax filing. A minor GST error or improper GST software can cause financial consequences and damage the reputation of your business. Let us highlight the common mistakes that e-commerce businesses make with GST compliance and the ways to avoid them for your business.

About GST Compliance for E-commerce Business

GST compliance encompasses various factors such as digital tax, GST filing, and tax rules, which are very crucial things in e-commerce GST. If any GST errors are found in the GST filing, it becomes difficult to address them. Incorrect documentation, missed deadlines, and improper classifications can cause legal trouble for your business.

It is important to ensure that GST returns are accurately calculated and submitted to claim for Input Tax Credit (ITC). To simplify the process and minimize human errors, GST Software is utilized for online tax calculations, automating GST returns and timely submissions.

Common GST Mistakes E-Commerce Businesses Make and How to Avoid Them

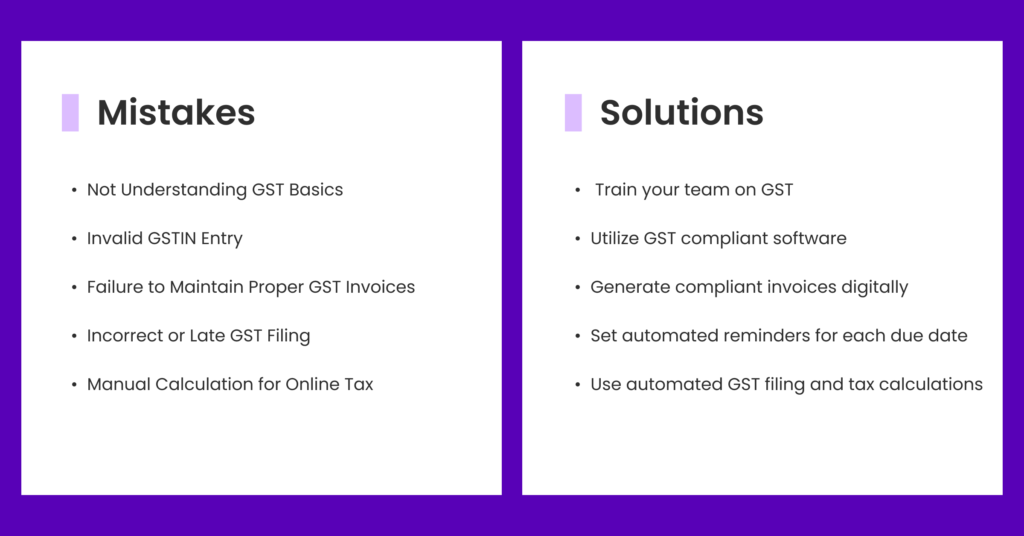

- Not Understanding GST Basics – Many e-commerce businesses do not grasp the basics of GST returns, which include important documentation and tax rules.

How to Avoid – Train your team on GST. Using digital software can also simplify the overall process, as it provides the latest updates on digital tax for e-commerce GST.

- Invalid GSTIN Entry – GSTIN is a 15-digit unique number assigned to every registered taxpayer, and if there is an error in its entry, it will lead to delays in tax filing and potential penalties.

How to Avoid – Utilize GST-compliant accounting software that reduces human errors and ensures the accuracy of GSTIN entries.

- Incorrect Classification of Goods and Services – Misclassifying the products or services is a common mistake that can result in incorrect GST rates, leading to underreporting or overreporting taxes.

How to Avoid – This issue can be resolved by using GST software that automates the product categorization process and applies the correct tax rates.

- Failure to Maintain Proper GST Invoices – Problems may arise due to an inability to claim ITC as there are missing details in the GST invoices.

How to Avoid – Using digital software will help you generate compliant invoices that will include all the necessary details, such as GSTIN, tax rate and unique invoice number to minimize errors.

- Incorrect or Late GST Filing – Submitting the GST returns incorrectly or late can lead to penalties, interest charges, or loss of Input Tax Credit (ITC).

How to Avoid – If you want automated reminders for each due date, you can use GST software, as it will also provide regular reconciliation of financial transactions on time.

- Neglecting Sales and Purchase Reconciliation – best ecommerce businesses sometimes fail to reconcile the sales and purchase invoices, which creates discrepancies in their GST returns.

How to Avoid – It is important to regularly reconcile the sales and purchase trends to align them with GST filing.

- Not Utilizing ITC Properly – ITC allows businesses to reduce tax liability, and if it is not tracked properly, many businesses can miss out on the benefits.

How to Avoid – All purchases can be tracked automatically through GST software, and if you claim ITC correctly, it will reduce your overall tax burden and maintain tax compliance.

- Manual Calculation for Online Tax– Manual calculation increases mistakes when applying tax rates if there is a high volume of transactions.

How to Avoid – GST filing and tax calculations should be done with the help of online software to reduce the chances of errors.

- Overlooking Reverse Charge Mechanism (RCM) – Ignoring RCM can lead to non-compliance and failure to pay GST on certain transactions for e-commerce businesses.

How to Avoid – You need to stay updated if RCM is applied to your business to ensure it is correctly reflected in your GST returns as well.

- Therefore, it can be said that if you want to avoid mistakes with GST compliance in your e-commerce business, you must ensure that your team is well aware of it.

- You need to leverage automation by implementing GST software to calculate tax and avoid GST errors.

- This will keep you on top of the payment deadlines, and you will handle multiple types of operations. So, avoid these mistakes and safeguard your e-commerce marketing from costly GST errors.

Frequently Asked Questions (FAQs)

How does GST software help in tax compliance?

It automates tax calculations, ensures accurate invoicing, sends reminders for due dates, reconciles sales and purchase invoices, and helps businesses apply correct GST rates.

What are the penalties for GST non-compliance?

Penalties vary based on the type of error, but they can include fines, interest charges, or even legal consequences for repeated violations.

Aachal has 5+ years of experience in retail technology and POS-related content, writing practical and insight-driven blogs for small businesses in India.